Solving Credit Card Fraud

Computer science associate professor Sam King thinks he has a solution to credit card fraud. Using his experiences in Silicon Valley and his research at UC Davis, King has developed a new, secure app called Card Scan that uses machine learning to read credit cards in seconds and reject fraudulent cards, transactions and phones.

“Research asks long-term questions and works on harder problems, and the company takes these ideas and builds real software for real people,” he said. “Combining the two together gives you the best of both worlds and in my opinion, you have to have both if you want to solve problems.”

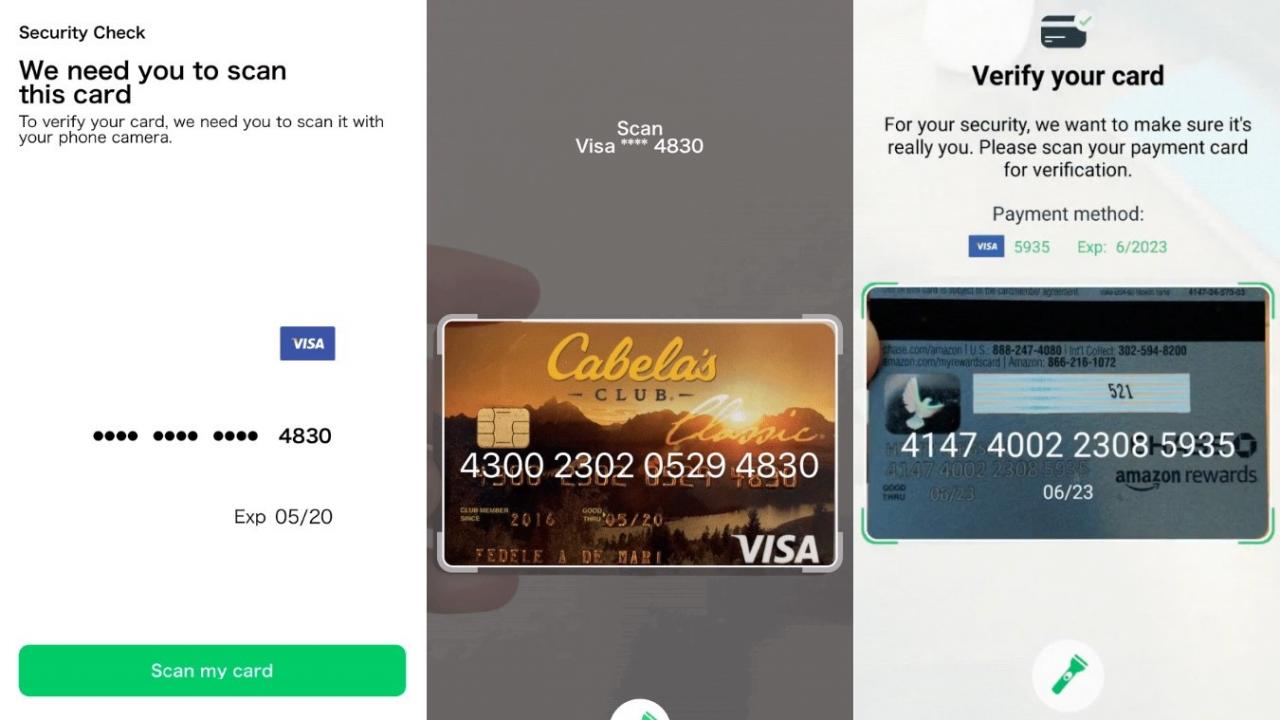

Card Scan, the first official product of his startup company Bouncer, is a software development kit (SDK), which is basically an app for apps. Card Scan reads images of real credit cards and captures the necessary information for secure payment while rejecting fraudulent schemes like images of cards, fake cards and phones used to scan thousands of cards. The technology comes entirely from King’s research at UC Davis.

“All of our tech is based on my lab’s research,” he said. “As a professor, I love having real-world impact, and starting a company and getting our software in the hands of users is a very good way of doing that.”

Thinking like fraudsters

The challenge of tackling credit card fraud is accounting for the wide range of ways people can carry it out. To train their machine learning algorithm, the team took a hands-on approach.

“To get a good sense of the fundamentals and to try to understand what was possible, we put ourselves in the shoes of the attacker and got really, really, really good at creating fake credit cards,” he said.

The team scanned 3.5 million fraudulent credit cards and honed the algorithm to identify even the most complex forms of fraud. Thinking like fraudsters allowed them to find the holes in their own systems, which was key to securing them.

“There’s a spectrum from humans with real phones and real apps who are entering credit card numbers manually, all the way to high-tech fraudsters running scripts and data centers, fully automating everything,” said King. “We’re responsible for all of it.”

Collecting this data into an app-friendly format turned out to be a challenge, since machine learning models are often large, complex and require a ton of data. The solution came from their research into ad-blocking in web browsers. To collect ad data, the team developed an efficient and lean machine learning infrastructure that could run seamlessly in a browser. When working on Card Scan’s framework, the group built off this study and were able to apply the lessons they learned to this new problem.

“Having a research perspective allowed us to make this connection and build a practical system,” he said. “Without having that experience with ad-blocking on browsers, we would’ve never been able to verify cards as well as we did.”

Commercial success

King founded Bouncer with fellow ex-Lyft employees Will Megson and Steven Liu to solve the fraud problem for all companies while reducing the bloat he experienced firsthand in industry. Most notably, the company was accepted to the prestigious and highly-competitive Y-Combinator program in 2019.

“Many of the biggest startups today have all graduated from Y-Combinator,” said King. “The program provides startup founders with information that they would just never be able to get on their own.”

As a result, King has seen adoption across Silicon Valley. So far, 496 apps have implemented their technology into their smartphone apps, including Groupon, iBotta and the American Cancer Society, and their software has scanned over 30 million cards.

The next step is refining the app and improving performance, so it can work well even on low-end smartphones. King believes that as they refine the software, the ideas will continue to catch on and they will make more strides toward ending credit card fraud once and for all.

“It’s just starting to take off, and it was all started from ideas that came here at UC Davis,” he said. “The research that we’re doing here is absolutely critical to the company’s success—in fact, it’s a competitive advantage.”